For example, the customer service staff can now tell customers exactly how many units are available for shipment. Also, the materials management staff can rely on the inventory records to plan for how many additional units need to be produced or ordered from suppliers. In addition, the accounting department can now rely on the inventory records to devise the ending inventory balance for month-end reporting.

ShipBob offers the ultimate inventory management software

Get a free demo today to see how Fabrikatör can transform your inventory management strategy. For instance, when a customer purchases a product, the inventory count for that item is immediately reduced in the system. Similarly, when new inventory arrives, the system updates the stock levels. This allows businesses to have a real-time view of inventory, which is crucial for ensuring products are always available to customers without overstocking. Periodic and perpetual inventory systems are two different inventory tracking methods that ecommerce businesses use to track and monitor stocked goods.

COGS

In contrast, periodic systems, which update inventory at set intervals, are often more suitable for smaller businesses with less frequent transactions. They require fewer resources and can be less costly to implement, as they don’t necessitate the same level of technological investment. The perpetual inventory system influences financial statements by providing a continuous and precise reflection of inventory data.

Transaction records

- Head over to our guide on journalizing transactions, with definitions and examples for business.

- Not only does it help track inventory data in real-time, but it also helps eliminate labor costs and human error.

- Here is a detailed explanation of how this kind of inventory system functions.

- However, it may not always provide the most tax-efficient outcome, as higher profits can lead to increased tax liabilities.

- While both the periodic and perpetual inventory systems requirea physical count of inventory, periodic inventorying requires morephysical counts to be conducted.

- The results dictate the optimal amount of inventory to buy or make to minimise expenses.

Learn the difference between demand planning and supply planning in ecommerce. A perpetual inventory system tracks stock movements and interactions throughout your supply chain, so you can pinpoint bottlenecks in your procedures and discover other valuable insights. FIFO (first in, first out) is an inventory valuation method that sells the goods purchased first before goods purchased later.

Does a perpetual inventory system use FIFO or LIFO?

This requires the use of point-of-sale terminals, barcode scanners, and perpetual inventory software to update estimated inventory with every product purchase and sale. Both merchandising and manufacturing companies can benefit from perpetual inventory system. It uses historical inventory and sales data to predict future sales trends and cycles and ensure you have the optimal stock at the right time of year, such as the holiday season. In contrast, you have to adjust the year-end inventory balance to match the physical inventory count results in a periodic system, which means you can’t attribute discrepancies accordingly.

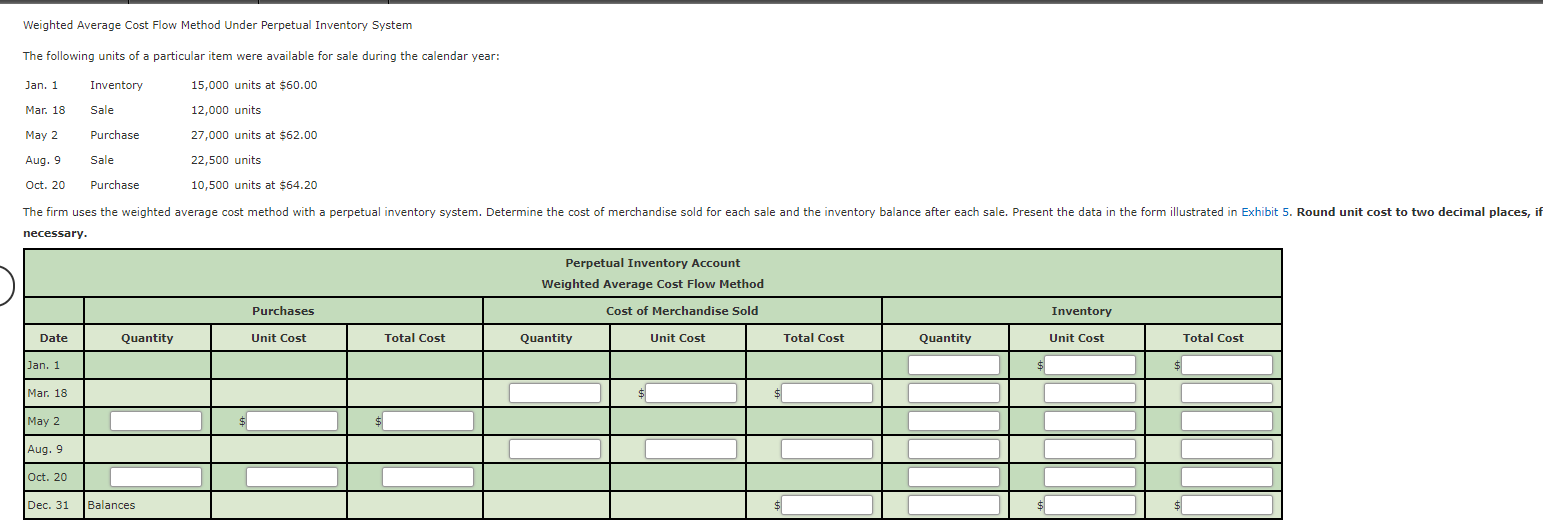

Before the end of the accounting period, it is impossible to decide on an exact COGS. When using this approach, a business needs to make more effort to maintain thorough records of the products it has on hand. In this guide, we will be explaining what a perpetual inventory system is, its what is turbotax live advantages, and whether or not it is the right inventory management practice for your small business accounting. Perpetual inventory systems correctly reflect the amount of inventory on hand. They maintain a running balance of both the inventory on hand and the cost of goods sold.

For instance, real-time inventory information is vital for the financial and accounting teams. Inventory can make up a large part of your stated assets, so integrating inventory management with financial systems helps ensure accurate tax and regulatory reporting. The accounting journal entries are based on 500 units being purchased at $3.00 per SKU for a total of $1,500.

This is generally done by a warehouse employee scanning the goods using warehouse management software. First, you record the $12.00 as a debit against your COGS on your income statement. The same $12.00 amount is recorded as credited to your inventory on your balance sheet. One day you make three sales through your online store, two sales from your physical shop, and one B2B sale of 10 items – all for the exact same product. Like many things in business, perpetual inventory has its advantages and disadvantages.